The future of the investment landscape will be shaped by:

Private Equity 2.0: Why Smart Consulting Is Now the Key to Sustainable Growth

Published on 31/10/2025

Private Equity 2.0: Why Smart Consulting Is Key to Sustainable Growth

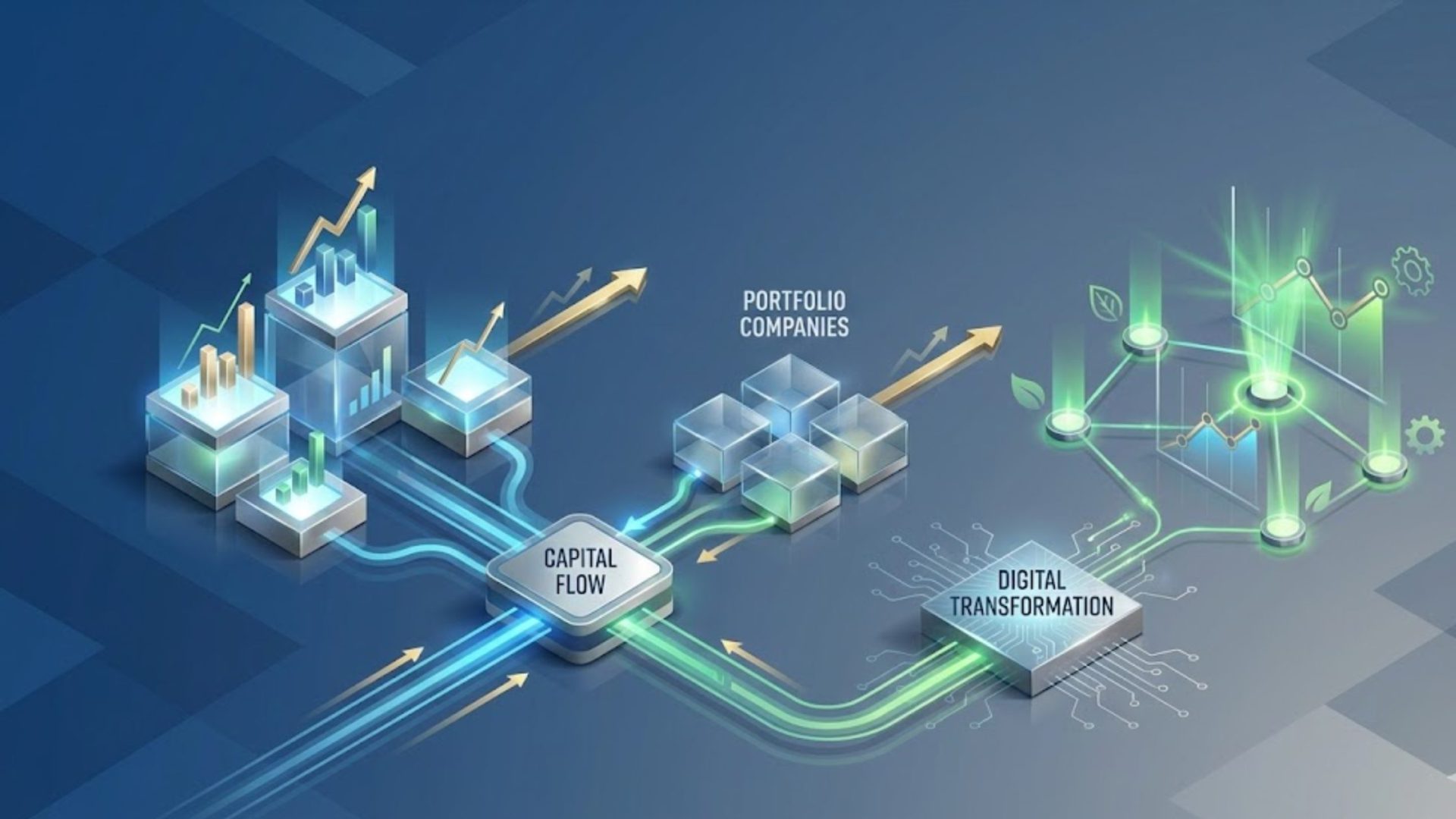

The private equity industry is undergoing a fundamental shift. Traditional value creation methods focused on financial engineering and cost restructuring are no longer sufficient in today’s competitive and dynamic market. This evolution has given rise to Private Equity 2.0—a modern approach that prioritizes long-term value creation through smart consulting, digital transformation, and ESG-driven growth strategies.

For private equity firms seeking sustainable returns, strategic private equity consulting has become a critical enabler across the entire investment lifecycle.

The Evolution of Private Equity: From Financial Engineering to Value Creation

Traditional private equity models relied heavily on leverage optimization, aggressive cost reduction, and short-term margin improvements. While effective in earlier market cycles, these approaches are increasingly constrained by tighter regulations, higher competition, and evolving investor expectations.

Private Equity 2.0 represents a shift toward:

-

Operational excellence

-

Technology-led transformation

-

Sustainable and responsible investing

-

Long-term enterprise value creation

Modern PE firms now focus on strengthening core business fundamentals rather than extracting short-term financial gains.

What Is Private Equity 2.0?

Private Equity 2.0 is a data-driven, strategy-led investment approach that integrates consulting expertise with capital allocation. Unlike traditional models, it emphasizes:

-

Digital transformation and automation

-

Advanced analytics and performance monitoring

-

Environmental, Social, and Governance (ESG) integration

-

Scalable operating models

This approach enables portfolio companies to become more resilient, competitive, and future-ready.

Why Smart Consulting Is a Game-Changer in Private Equity

Smart consulting in private equity combines deep industry knowledge with analytics, technology, and strategic execution. It supports PE firms from deal origination to exit, ensuring value creation at every stage.

Key Areas Where Smart Consulting Creates Impact

Operational Efficiency

Consultants help streamline procurement, supply chains, and internal processes across portfolio companies, reducing costs while improving productivity. By standardizing workflows, eliminating operational bottlenecks, and optimizing vendor management, private equity consulting teams unlock measurable efficiency gains. These improvements not only enhance short-term margins but also build scalable operating models that support long-term growth across multiple portfolio entities.

Risk Identification and Mitigation

Advanced analytics are used during due diligence to uncover financial, regulatory, operational, and cyber risks—minimizing post-acquisition surprises. Smart consulting enables PE firms to assess risk holistically by combining data insights with industry expertise, ensuring potential red flags are identified early. This proactive approach strengthens investment decisions, protects capital, and improves overall portfolio resilience throughout the holding period.

Portfolio Optimization

Performance dashboards and KPI frameworks enable PE firms to identify underperforming assets early and implement corrective strategies. Consultants work closely with management teams to redesign operating structures, realign business priorities, and improve capital allocation. Continuous monitoring ensures that value creation initiatives remain on track and that portfolio companies consistently move toward defined growth and profitability targets.

Industry examples consistently show that operational improvements and strategic execution—not just financial restructuring—drive superior private equity returns. Firms that combine smart consulting with investment expertise outperform peers by creating sustainable, scalable value rather than relying solely on leverage and cost reduction.

Have questions or want to explore how these strategies can be applied to your organization? Contact our team to discuss your requirements and understand how Inspirigence Advisors can support your growth objectives.

Core Components of Effective Private Equity Consulting

1. Data-Driven Decision Making

Modern private equity consulting leverages AI, predictive analytics, and real-time reporting to:

-

Identify growth opportunities

-

Monitor portfolio performance

-

Support evidence-based strategic decisions

This enhances both investment accuracy and execution speed.

2. ESG Integration and Sustainable Growth

ESG has become a central pillar of private equity strategy.

Key benefits include:

-

Reduced regulatory and reputational risk

-

Improved operational efficiency

-

Stronger alignment with institutional investors

Embedding ESG principles supports long-term value creation while strengthening stakeholder confidence.

3. Strategic Operational Support

Private equity consultants work closely with management teams to:

-

Optimize processes and cost structures

-

Improve pricing and revenue models

-

Support digital adoption and cultural transformation

This hands-on operational support is critical for scaling portfolio companies efficiently.

4. Risk Management and Compliance Advisory

Effective consulting ensures portfolio companies remain compliant and resilient through:

-

Regulatory compliance frameworks

-

Financial risk assessment and mitigation

-

Integrated governance and control systems

This protects investment value throughout the holding period.

Benefits of Integrating Consulting into Private Equity Deals

-

Higher ROI and Portfolio Performance

Consulting identifies operational and strategic levers that enhance enterprise value. -

Improved Due Diligence Quality

Data-backed analysis reduces uncertainty and post-deal risks. -

Sustainable Investor Value Creation

Focus on long-term growth rather than short-term financial engineering.

How Private Equity Firms Can Adopt Smart Consulting

Integrate Consulting Across the Investment Lifecycle

From deal sourcing and due diligence to portfolio management and exit planning, consulting should be embedded—not treated as an add-on.

Partner with the Right Advisory Firm

Choose advisors with:

-

Proven private equity experience

-

Industry-specific expertise

-

A track record of operational value creation

Align Consulting with Digital and ESG Goals

Ensure advisory initiatives directly support technology adoption and sustainability objectives.

The Future of P.E. : Consulting as a Core Growth Driver

-

AI-enabled decision-making

-

Advanced analytics

-

ESG-driven investment frameworks

-

Integrated consulting models

Firms that adopt these capabilities early will achieve stronger returns, lower risk exposure, and sustainable competitive advantage.

Conclusion: Smart Consulting as the Foundation of P.E. 2.0

Private Equity 2.0 marks a decisive shift toward strategic, sustainable, and data-driven investing. Smart consulting is no longer optional—it is a core driver of long-term value creation.

By integrating operational expertise, digital transformation, and ESG principles, firms can build resilient portfolios and deliver superior investor outcomes in an increasingly complex global market.

Partner with Inspirigence Advisors to strengthen your growth strategy, enhance portfolio performance, and drive sustainable value creation through expert-led consulting.